RITA CRUNDWELL FRAUD PROFESSIONAL

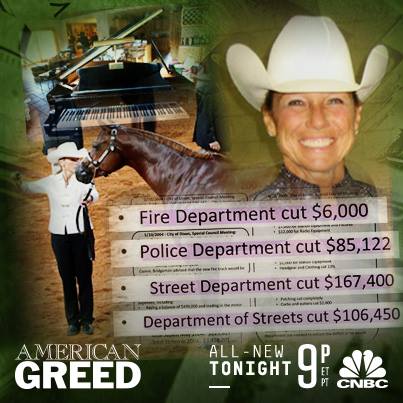

Clifton is one of the most deft box-checking firms out there but it will be tough convince anyone they aren't liable just because they complied with professional standards.ĬPA firm knew about secret bank account ġ Or something. Crundwell, accused of misappropriating more than 53 million from the city where she served as. If a judge and/or jury decides that auditors/accountants were grossly negligent despite evidence that shows that they checked all the right boxes, it won't matter. Rita Crundwell, former comptroller for Dixon, Ill., leaves federal court in Rockford, Ill. I don't know! Professional standards are great and all, but sometimes in court it doesn't make any difference. Rita Crundwell, former comptroller for the City of Dixon, Ill., turns away as her attorney briefly speaks with the media. If that's the case, shouldn't that get CLA off the hook? The 67-year-old woman's release date was supposed to be Oct.

It is believed to be the largest theft of public. 14, 2012, to wire fraud, and agreed she also engaged in money laundering, in connection with stealing more than 53 million from the city since 1990 and using the proceeds to finance her quarter horse farming business and life of luxury. Now, if there was "a change in scope" that's a different story but nothing in the article indicates that the former conversation DIDN'T happen or that the latter conversation DID happen. Crundwell, 60, formerly of Dixon, pleaded guilty on Nov. A former longtime comptroller for Dixon, Ill. Isn't that interesting, man? If CLA/CG did the "establishing an understanding" then Dixon would have been perfectly aware of what the firm was doing and, more importantly, what they are NOT doing. If the accountant was engaged to perform an audit in accordance with GAAS or was engaged to review the financial statements in accordance with SSARSs, prior to agreeing to change the engagement to a compilation, did the accountant consider (a) the reason given for the client’s request, particularly the implications of a restriction on the scope of the audit or review whether imposed by the client or by circumstances, (b) the additional audit or review effort required to complete the audit or review, and (c) the estimated additional cost to complete the audit or review?

0 kommentar(er)

0 kommentar(er)